Zobaze | Acquisition project

Are you a store owner still relying on traditional methods like pen and paper?

We understand the daily struggles you face—from managing your stock to monitoring your staff. Amid all the firefighting, tracking your daily sales, cash flow, profits, and expenses often gets overlooked. It’s tough to make better business decisions in the midst of all this chaos, isn’t it?

But not anymore. The solution is right in your hands—your smartphone. Get the Zobaze POS app, specifically designed to simplify business operations for small and medium-sized business owners.

Our suite of B2B utility mobile applications enables you to run your business effortlessly from anywhere, right from the comfort of your fingertips.

Product | Zobaze

Zobaze provides apps like Zobaze POS for retailers, Restokeep for restaurants, and Bizli for small stores, offering features like:

- Inventory Management: More than just adding inventory, it offers low stock, dead stock, and top-selling stock alerts.

- Staff Management: Business owners can manage their business from anywhere while the staff runs the store. Owners can monitor staff attendance, sales, and payroll.

- Advanced Sales Reports: Moving beyond traditional methods, users can track their sales, profits, expenses, and cash flow on a daily, weekly, monthly, and yearly basis.

- All-in-One POS Solution: This allows users to make sales, connect a printer to their mobile, print receipts, and share them with customers via WhatsApp or email.

Is Zobaze ready for Acquisition?

Tried by; Zobaze has expanded to 190+ countries, achieving over 2 million downloads.

AHA moment; Users say goodbye to traditional methods, saving both time and effort, while gaining better visibility into their sales and profits. Zobaze has a 4.5-star rating on the Google Play Store from 20,000+ reviews.

Brag-worthy; For store owners with limited exposure to technology, being able to manage their business through a smartphone is something worth bragging about. The fact that word of mouth is the second-largest source of user acquisition is proof of that.

Ideal Customer Profile (ICP)

To structure the ICP mapping and get a clear understanding of our customer base, I combined both user calls and a survey approach.

After speaking with over 50 users and validating the hypothesis through a survey, which gathered insights from 230+ users, I created this ICP mapping.

Reference to the Survey

Criteria | ICP1 | ICP2 | ICP 3 | ICP 4 |

|---|---|---|---|---|

Name | Raju | Praful | Bhagat | Nancy |

Age | 35-45 | 25-35 | 30-35 | 30-40 |

Location | Tier 1 & Tier 2 cities | Tier 1 & Tier 2 cities | Tier 1 & Tier 2 cities | Tier 1 cities |

Tech Literate | Limited - knows basic smartphone features | Moderate - uses social media apps often | Moderate - uses social media apps often | High - aware of software and payments |

Business Type | Small Stores | Retail | Wholesale | Restaurant /Cafe |

No. of staff | 0 | 1-3 | 3-5 | 5+ |

Organization Structure | Owner alone or with a family member when absent | Owner + Staff | Owner + Manager + Staff | Owner + Manager + Partner + Staff |

Pain points for downloading | 1. Time-consuming manual processes. 2. Hard to manage customers in peak hours. 3. Difficulty tracking in-debt customers. | 1. To manage Inventory. 2. To track Sales. 3. Billing. | 1. Manage bulk inventory. 2. Manage invoices. 3. Manage staff. | 1. Simplify restaurant operations (inventory/orders). 2. Reduce manual work. |

AHA moments | 1. Easy-to-use POS. 2. Affordable. 3. Data security. | 1. Saves time. 2. Simplified store operations. 3. Visibility into sales. | 1. Organized operations. 2. Professional client interactions. 3. Sales visibility. | 1. Efficient staff management. 2. Smooth restaurant operations. 3. Sales visibility. |

Decision influencer | local community or family-run business circles | competitors or online recommendations | Trusted peers or colleagues | Partner + online recommendations |

Decision Blocker | 1. Fear of data security. 2. Afraid of tech literacy and digital systems. | 1. Prefers free over paid plans. 2. Looks for immediate benefits. | 1. Concerned about compatibility. 2. Prefers referrals for tech. | 1. Needs convincing for partner. 2. Always seeking new features. |

Appetite to pay | Low - prefers affordable options, hesitant to invest | Medium - Willing to pay but compares options | High - Willing to pay for long-term solutions | High - Loyal if product meets business needs |

Other tools used | WhatsApp for orders and communication. Tally or Excel for accounting. | QuickBooks, Excel, CashBook for accounting. WhatsApp for expense tracking. | Accounting apps, Invoice maker. WhatsApp for attendance. | Social media for promotion. Food delivery apps. Excel for accounting. |

Business Goals | 1. Reduce workload and stress. 2. Maintain good customer relations. | 1. Focus more on strategy than operations. 2. Expand multiple businesses. | 1. Scale existing business. 2. Improve operational control. | 1. Serve customers better. 2. Open new branches and manage centrally. |

Social Media apps used | WhatsApp, Facebook, YouTube | WhatsApp, Facebook, Instagram | Facebook, YouTube, WhatsApp | Facebook, YouTube, WhatsApp |

Free time spent | Watching social media or movies | Spending time with friends and social media | Netflix and social media | Spending time with family |

Decision Time | High - cautious and slow to decide | Low - quick decision-maker | Medium - considers options thoroughly | High - thorough research before deciding |

Customer Journey Map

ICP Prioritization

Criteria | Adoption Rate | Appetite to Pay | Frequency of Use Case | Distribution Potential | TAM |

|---|---|---|---|---|---|

ICP 1 - Small Stores | Low - hesitant to adopt | Low - cost conscious | Low | Low | Medium |

ICP 2 - Retail | Medium - Will adopt with right value proposition | Medium - compares all options | Medium | Medium - active on social media. | High |

ICP 3 - Wholesale | Medium - Adopts but looks for reliability & trust | High - for efficient tools | Medium | High - Wholesaler customers are Zobaze customers | Low |

ICP 4 - Restaurant | High - Open & Must-to-have | High - invests in right tools | High | High - Active on social media. | High |

Based on the ICP prioritization framework, Zobaze should primarily focus on ICP 2 - Retail and ICP 4 - Restaurant. Then ICP 3 - Wholesale.

Reasons:

- Retail is the largest market, and with the right value proposition & communication, Zobaze can capture a solid share. Plus, 60% of Zobaze’s current users are already retailers, proving this focus works.

- Restaurant owners have the highest appetite to pay and a high adoption rate, making them a key target.

- Wholesalers, while willing to pay, are more cautious in their decisions and operate in a smaller market. Having said that, Wholesalers are potential partners to launch partnership programs.

- Small stores have lower adoption rates, limited willingness to pay, and it's harder to reach them.

Competitors in the Market

Store Revenue world-wide (Last 30 days) | Acquisitions world-wide (Last 30 days) |

|---|---|

|

|

Note: Above revenue includes only in-app purchases & no Ad revenue.

The data above highlights two key points:

- There is a gap in user acquisition for Zobaze.

- Competitors (Especially Khatabook) are acquiring users at seventeen times Zobaze's current rate, indicating a promising market size.

Tool used to capture the data ---> Sensor tower.

Competitor Strengths & Weaknesses Compared to Zobaze

App | Strengths | Weaknesses |

|---|---|---|

Khatabook |

|

|

Vyapar |

|

|

Loyverse |

|

|

MyBillBook |

|

|

Kyte |

|

|

Calculating TAM for Zobaze: A Bottom-Up Approach

As Zobaze designs its roadmap, the most effective way to calculate its Total Addressable Market (TAM) is through the Bottom-Up method. To eliminate as much assumptions as possible.

How?

- 1. Identify the Number of Retail SMEs Globally:

- According to Statista, there are approximately 358 million retail small and medium enterprises (SMEs) worldwide.

- 2. Calculate the Average Revenue Per User (ARPU):

- ARPU is calculated as: Total revenue made / Total number of purchases.

- For Zobaze, the ARPU is estimated to be INR 2,894.

- 3. Determine the Total Addressable Market (TAM):

- TAM is the product of total potential customers & ARPU.

- Zobaze’s TAM estimation: INR 1 Trillion (1 lakh crores).

Note: Above analysis only focuses on SMEs. The overall global POS software market size is as below.

Calculating SAM for Zobaze: The Portion of TAM Zobaze Can Serve Today

Enterprise Limitation

Although Zobaze serves enterprises with 500+ staff, it lacks several key features that are typically required by businesses, such as: Invoicing, Social media integrations, Waste management tools, and Desktop and iOS versions.

iOS Market Share

Globally, 30% of smartphone users are on iOS, which Zobaze does not support. This reduces its potential market size further.

Fixed POS Preference: Desktop version

Fixed POS systems account for 55% of the global POS revenue share, and Zobaze's current offering primarily targets mobile users.

Thus, the final Serviceable Available Market (SAM) for Zobaze is ₹25,200 crore.

Calculating SOM for Zobaze: The Portion of SAM Zobaze Can capture over competitors

Among all competitors, Zobaze is the only Mobile POS available only on Android, making it challenging to predict an exact SOM.

While the total TAM is ₹1 lakh crore, competitors have a broader reach—they are available on both iOS and desktop, offer advanced features (such as invoice generation), and cater to larger businesses. This places them in both the space Zobaze operates in (the ₹25K crore SAM) and the entire ₹1 lakh crore TAM.

So, we're considering competitor acquisitions on Android.

Vyapar: 10 Million.

Khatabook: 50 Million.

MyBillBook: 5Million.

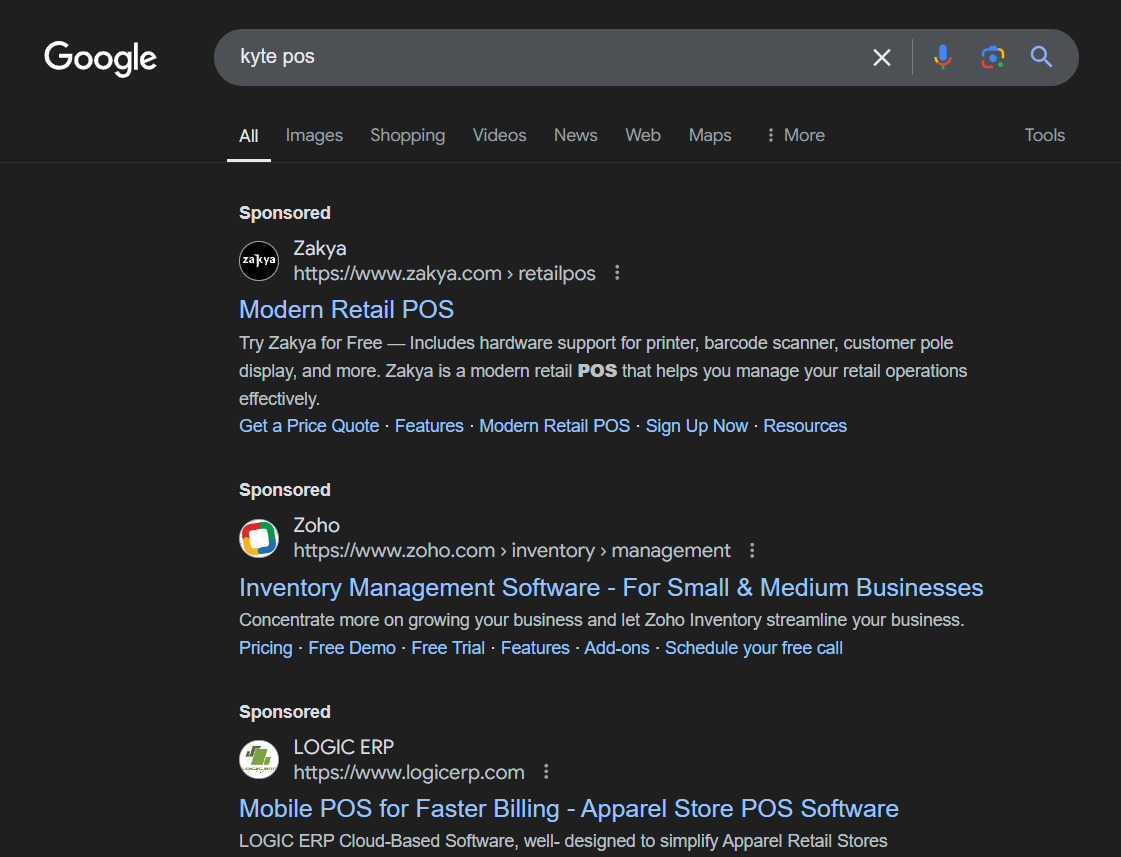

Kyte: 1 Million.

Loyverse: 1 Million.

Zobaze: 1 Million.

i.e., All are in the ratios of ---> 10:50:5:1:1:1

So, out of 25,200 crores (Zobaze SAM), SOM could be - ₹370 crore.

So, out of 25,200 crores (Zobaze SAM), SOM could be - ₹370 crore.

Zobaze's Core Value Proposition

Zobaze empowers SME business owners to take complete control of their operations by providing real-time visibility into sales, profits, and cash flow. It replaces manual tasks, helping them save time and organize their store operations.

In a recent survey, 84% of users reported that Zobaze helps them effectively track their sales, profits, and cash flow. Additionally, 54% mentioned that Zobaze has helped them save time and organize their store operations.

Why users prefer Zobaze over competitors?

- Zobaze is very easy-to-use compared to other players in the market.

- Zobaze is relatively very affordable.

- Zobaze offers free plan for life-time.

Journey mapping

1. Retail (ICP 2 - Praful)

User Story:

As a retail store owner, I want a system that helps me easily manage inventory, sales, and billing, so I can focus on growing my business and save time on day-to-day operations.

Journey Map:

- Discovery:

- Praful hears about Zobaze through social media or a peer recommendation.

- Touchpoint: Social media ad, Referral link, App Store search.

- Potential friction: Not convinced of the value, may hesitate to download.

- Experience: Curious but cautious.

- Onboarding:

- Downloads the app and begins setting up his inventory.

- Touchpoint: App download -> Sign-up -> Tutorial.

- Potential friction: The onboarding process may seem complicated if not simplified.

- Experience: Frustration if setup is not quick, relief if it's intuitive.

- First Use:

- Praful starts entering his stock and sees real-time sales tracking and billing.

- Touchpoint: Dashboard -> Inventory management -> Sales tracking.

- Potential friction: Might struggle with learning the flow of the app.

- Experience: Feels empowered by seeing organized data, relief as inventory is under control.

- Adoption:

- Praful realizes the app is saving him time and reducing errors in sales and stock management.

- Touchpoint: Push notifications -> Sales report -> Inventory alerts.

- Potential friction: May resist paying for the premium version unless value is clearly demonstrated.

- Experience: Relief and satisfaction, growing confidence as he sees results.

Experience Mapping:

- Emotional High: After using the app to manage inventory and track sales accurately, Praful experiences satisfaction, knowing he’s saving time and preventing stock issues.

- Emotional Low: The setup process could be overwhelming initially, especially if he’s not used to using digital tools.

- Core Value Proposition Experienced: Simplified inventory management, accurate sales tracking, and billing lead to operational efficiency.

2. Restaurant (ICP 4 - Nancy)

User Story:

"As a restaurant owner, I need a solution to manage my staff, orders, and inventory efficiently so I can ensure smooth daily operations and focus on customer satisfaction."

Journey Map:

- Discovery:

- Nancy learns about Zobaze through a restaurant owner’s community or while researching online.

- Touchpoint: Community referral, Web search, Social Media influencers.

- Potential friction: She might compare it with other tools and be unsure of its unique benefits.

- Experience: Excitement but also skepticism.

- Onboarding:

- Nancy starts setting up her restaurant’s staff and menu on Zobaze.

- Touchpoint: App setup -> Staff management feature -> Menu/inventory setup.

- Potential friction: Ensuring the system integrates well with restaurant-specific needs (e.g., managing orders, staff roles).

- Experience: Initial overwhelm due to the complexity of managing multiple processes, but satisfaction when the system is up and running smoothly.

- First Use:

- She sees the system managing orders efficiently during peak hours and staff being able to focus more on service.

- Touchpoint: Order management, Staff scheduling, Inventory updates.

- Potential friction: Could face issues with syncing orders and stock during peak times.

- Experience: Relief seeing smooth operations during busy hours, fewer manual interventions.

- Adoption:

- Nancy regularly uses Zobaze for smooth inventory, order management, and payroll management.

- Touchpoint: Push notifications for low stock, Reports on sales, Order fulfillment updates.

- Potential friction: She may want additional features or integration with delivery apps.

- Experience: High satisfaction with restaurant operations under control, eager for new features.

Experience Mapping:

- Emotional High: Seeing Zobaze manage staff and inventory efficiently during peak times, resulting in a seamless dining experience.

- Emotional Low: Setup could feel complex at first, with potential frustration in integrating all the moving parts of a restaurant.

- Core Value Proposition Experienced: Zobaze enables efficient staff management, smooth inventory flow, and order handling, ultimately improving customer service and reducing operational strain.

Zobaze, launched in 2018 and currently in the early scaling stage, has explored various acquisition channels, including organic through ASO, paid campaigns via Google Ads, and partnerships through reseller programs.

While these channels have shown success, there remain gaps and ample opportunities to expand our user base further. With our experience and the historical data, our focus now is on deep diving into existing channels rather than branching into new ones.

Validating the Acquisition channels with prioritization framework

Zobaze is in the early scaling stage, so we need to limit additional effort and costs for acquiring new users. However, the focus is on channels that deliver faster results, offer flexibility, and can scale as company goals evolve.

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

Organic - ASO | Low | High | Medium | High | Medium |

Paid - Google Ads | High | High | Medium | High | High |

Referral Program | Medium | Medium | High | Low | Low |

Product Integration | High | Low | High | Low | Low |

Referral program | Low | Medium | Low | Medium | Medium |

- Organic: ASO – Low-cost with high flexibility, requires minimal effort, delivers faster results, and offers decent scalability.

- Paid: Google Ads – Although it’s high-cost, it requires little effort and provides a strong ROI. Plus, it offers visibility into key metrics like CTR, ROI, impressions, and conversions, which are valuable for strategy-building.

- Referral program – Since our ideal customers trust recommendations from their peers, referrals could be a powerful channel for us. At Zobaze’s current stage, a referral program is ideal because it’s quick to set up, easy to manage, and shows results without much effort or high costs.

So, relying on existing channels & diving deep into them seems fruitful.

As a mobile-first platform with products primarily on Android, Google Play Store serves as Zobaze's largest distribution channel.

With over 77% of users searching directly on Play Store rather than on the web, this channel is crucial for reaching and engaging our target audience effectively.

Let's uncover ASO - The App Store Optimization

ASO is all about using the right keywords (metadata) to drive users to your store listing, then capturing their interest with powerful screenshots. Sounds simple? Not quite!

Let’s break down how users actually search on Play Store:

- Use Case Searches: Many users start by looking for a specific solution or use case.

- Examples: “Inventory management apps” (Use case) or “Easy-to-use POS app” (Solution-first search).

- Competitor Searches: Some users know a brand and search directly for it.

- Example: “Loyverse POS app.”

- Your Brand Searches: Users who know your brand from word-of-mouth, social media, or even your competitors.

- Example: “Zobaze.”

The real opportunity lies with users who search by use case—they’re exploring and open-minded, checking out the top results without any brand bias. Capturing these users requires well-chosen keywords to bring them to your store listing.

But once they’re there, how do you get them to hit “Download”?

Your content and visuals need to connect with user goals and highlight those key “aha” moments. Think of it as telling a story that guides them from curiosity to commitment.

There are two types of users:

- Decisive

- They will either Drop/Install with the first impression. They’re more likely to uninstall app soon, for they doesn’t have strong intent.

- Explorer

- They will explore the Screenshots, Reviews & Ratings, Total downloads. They’re less likely to uninstall the app.

- They will explore the Screenshots, Reviews & Ratings, Total downloads. They’re less likely to uninstall the app.

Always solve for the Explorers

Historical Data Insight: So far, Zobaze has focused on localization, tailoring store listings for users from different regions with relatable visuals and translations to capture users searching in various languages. This approach has led us to create Custom Store Listings (CSLs) aimed at specific audience groups. But is localization alone enough to fully capture our target market?

Let’s take a closer look at our own product, feature by feature:

- Inventory Management

- Staff Management

- Sales, Profit, Cash Flow, and Expense Tracking

- POS System

- Customer Management

- Table Management

Different ICPs, Different Needs

Each of our target customer profiles (ICPs) has unique needs when they search on the Play Store:

- ICP A: "I run a small store with minimal stock, but I need help tracking my sales. Let me find an app for that."

- ICP B: "I own a restaurant and need an app to manage table reservations."

- ICP C: "I manage a retail store and want an all-in-one POS app. Let’s check the Play Store."

- ICP D: "As a wholesaler, I need an app to manage my inventory."

While our app covers all these features, each ICP uses specific keywords in their search. A single, generic title, description, or screenshot won’t effectively capture each of these users.

A Solution: Search-term Based Custom Store Listings (CSLs) - With Google Play Console’s recent updates, we can now create CSLs that adapt titles, descriptions, and visuals based on user search terms, making each listing highly relevant to individual needs.

Proof in Practice

Competitors like Vyapar are already leveraging this strategy and seeing 5x the daily acquisitions compared to Zobaze. By adopting search-term-based CSLs, we can target our audience more accurately, boosting visibility and conversions on the Play Store.

Let's put this into action for the search-term:- POS

Attracting users: With Metadata

- Visibility Test:

- Using the links (reference), explored apps that appear in TOP 5 when searched for “POS” in major countries, like: Philippines, Malaysia, India, South Africa, Egypt, Indonesia, Zimbabwe, USA, Nigeria, Mexico.

- Findings: Reference

- Loyverse is getting highest visibility. In 90% of the cases, it’s always on top.

- Zobaze is not visible in top 10 list in countries we have translations (As translated variant doesn’t contain POS word in it). But we’re appearing for search term - “POS app“

- Competitor Analysis:

- Though there are multiple apps, top performing apps are: Loyverse, Kyte, Square, SumUp, & Zobaze POS (This is based on Avg downloads/day & Top free & grossing charts).

- Tools used: App brain (For avg downloads & rankings per country) + App Follow (For Top chart rankings).

- Reference

- Metadata Analysis:

- For different countries, did metadata analysis of competitors (concentrating only on POS & its combinations).

- Tools used: AppTweak (Free trial)

- Learnings:

- We’re neither ranking enough for word “POS“ nor getting enough installs. This says users are not finding our CSL relevant to what they’re searching for “POS“.

- Loyverse & Jio POS Plus is getting the most installs for word - “POS“. As Loyverse is used worldwide, we’re taking Loyverse as the reference in building our CSL for search term - “POS“.

- Reference

Converting users: With Screenshots

- User goals: As a business owner, I want a perfect, affordable, easy-to-use, convenient system for my needs.

- Perfect: We’ll position our Zobaze POS as All-in-one solution (Owners can add items, make sale, print/share receipts, track reports).

- Affordable: Will showcase Free plan for lifetime (Limited access).

- Easy-to-use: Will display screens with relatable features: Inventory management, Accept multiple payment methods, Add staff…

- Convenient: Offline feature. Advanced sales reports. Connecting printer.

- Aha moments: Make more profits, Save time, Run business from anywhere, Try Free trial without card.

- Problems: Managing stock manually. Accepting multiple payments. Receipt keeping. Customer support.

Now that we’ve built a search-term (POS) basis store listing with right keywords and clear value communication, it might feel like the work is done—but not yet. To measure success, we’ll need to track store listing visitors, acquisitions, & conversion rates closely.

Observations:

- Currently, only 26% of users who find our app through the "POS" search term are converting.

- We're also ranking for unrelated keywords, like "Maynilad app" (a Philippines water billing app), resulting in a 0% conversion rate there.

- Additionally, a large portion of unknown search terms is categorized as "Other," suggesting there's a gap in our keyword targeting.

To address this, we’ll run a 14-day experiment, covering two weekends when user exploration is usually higher, to monitor and re-evaluate key metrics.

Now we have targeted only POS search term, with the many CSLs we need to create for each feature and use case, the potential is huge.

Once these are all live, we could increase our user base by 50%, reaching 2 million users.

Why PAID channels when we have built a kickass strategy for Organic?

The idea of paid ads is to get future customers today by being fast-paced. The best businesses are often futuristic.

So, let's kickstart with the fundamentals.

Calculating Cost Acquisition Cost (CAC) : Life Time Value (LTV)

Calculating LTV;

As a B2B SaaS platform using a freemium model, the best way to calculate LTV is by dividing the Average Revenue Per User (ARPU) by the churn rate.

- ARPU for 2023: 2895 INR.

- Churn Rate for 2023: Out of 36,289 paying users, 1929 canceled their subscriptions voluntarily, resulting in a churn rate of 5.32%.

LTV = ARPU / Churn rate = INR 544.

Calculating CAC;

In 2023, we spent INR 3 per user install. Now, we’re calculating the cost per paying user. Since only 2% of our users are paying, the actual CAC is INR 182 (see calculation below).

CAC : LTV = 182 : 544 = 3:1

This means that for every 1 rupee spent on acquiring a customer, 3 rupees (or more) are generated in lifetime value. Which is considered decent in SaaS companies.

Selecting the right ICP

Wait! Haven't we already mapped out our ICP? So why do it again? -- To hit the bullseye.

Unless we’re sure our ads are reaching the right ICP—the users who showed the highest PMF—we’re inviting everyone in. Let’s focus on attracting the right ICP, the ones who retain long enough to boost our LTV.

Who would it be among Praful, Nancy, & Bhagat?? Read the above lines again - users who showed highest PMF & retain long enough - Praful - The Retailer, right. Praful frequently uses Facebook and Instagram and actively searched for apps like Zobaze on Google. Also, users actively searching on Google has high intent.

Since we’re already running Google Ads, let’s identify any gaps and optimize them further. Additionally, let’s explore Meta Ads for greater reach.

Google Ads - Existing campaigns

We are having two Ad groups: 01 & 02 as below:

Ad group 01 | Impr. | CTR | Conv. rate (install) |

Free Point of Sale for Retail | 10553 | 7.88% | 36.66% |

Billing App for Pharmacy Stores | 6778 | 3.39% | 34.35% |

Point of sale and Inventory | 13713 | 8.42% | 37.75% |

Retail Point of sale offline | 6488 | 5.07% | 35.56% |

Inventory for Retail Store With Barcode & Know your high margin, high frequency SKU's | 10087 | 1.84% | 39.78% |

Billing, Inventory Management, Customer Management & Expense Management for Retail Shop | 6843 | 3.46% | 37.39% |

Billing app for Small and Medium Business | 6590 | 1.7% | 46.02% |

Restaurant POS & Online Order | 1917 | 9.7% | 43.55% |

Billing, Inventory & Customer | 8083 | 5.16% | 31.74% |

Know your shop report from anywhere | 1304 | 0.15% | 50% |

Ad group 02 | Impr. | CTR | Conv. rate (install) |

Try out to know your margins | 2685 | 6.96% | 32.45% |

This app is not a accounting software, this app is a bookkeeping cashflow management app. | 4546 | 8.91% | 16.67% |

Over million happy customers are using app to improve their profits | 5310 | 9.15% | 19.3% |

Understand your daily sales | 3102 | 6.22% | 17.35% |

Try out to know your daily cashflow, low stock inventory and inventory gives high margin | 4957 | 9.26% | 17.83% |

Try out the app and improve your profits with no new sales. | 4455 | 9.72% | 17.01% |

Increase your margins by 10-20% , just by adding sales & expenses of the store. | 5026 | 8.18% | 14.84% |

Summary

Ad group | Impressions | Interactions | Interaction rate | Conv. rate | Conversions |

Ad group 1 | 647352 | 30812 | 4.76% | 8.04% | 2477 |

Ad group 2 | 603645 | 73428 | 12.16% | 3.84% | 2817 |

In Ad Group 01, we’re using direct communication, while Ad Group 02 uses a more indirect approach. As a result, Ad Group 02 has a higher interaction rate, but Ad Group 01 leads with a higher conversion rate.

Interactions are based on Creatives & copies. Conversion rate is based on how relevant the store listing is to the ads.

This shows that users from Ad Group 02 aren’t finding our app’s store listing to be what they expected.

With Google Play Console’s new option to create Custom Store Listings (CSLs) for specific ads, we can adjust the listing to better match their expectations and increase conversions.

With our organic strategy of creating feature-specific Custom Store Listings (CSLs) based on search terms (e.g., POS), we can align this with our Google Ads strategy. By designing ad copies and creatives tailored to each CSL, we can improve targeting and boost conversions.

Since we already have a CSL for POS, let’s start there for the Google Ads strategy. Once this is set, we can apply the same approach to other features as their CSLs go live, such as Billing & Invoice, Inventory Management, Staff Management, Sales Tracking, and more.

Ads campaign targeting users looking for - POS

Google Ads

Variant 01

Heading: All-in-one POS for your Store.

Description: Spend time on increasing revenues not managing your store.

Variant 02

Heading: Try our Easy-to-use POS for free

Description: Leave the operations burden to us. Your store needs the digital touch.

Variant 03: Display Ad

Meta Ads

We can apply the same strategy on Meta platforms, like Instagram and Facebook, where our Ideal Customer Profile (ICP) is highly active.

Couldn't create a demo Ad on Meta as Business ID is mandatory to go ahead.

Users who come to the PlayStore listing through these ads will see a Custom Store Listing focused on POS, designed to improve conversions.

After the ads are live, we’ll track key metrics to see how effective this approach is, and we can tweak this or expand it to highlight other features like Billing & Invoice, Inventory Management, Sales Tracking, and more. This approach will also help us understand which features are most in demand, allowing us to refine our communication strategy.

KPIs to track:

- Days 3: Important to track the reach, engagement, and costs. So, track Impressions, Clicks, CTR, CPC.

- Days 7: Here, start tracking completed actions like Conversions, Conversion Rate, CPA.

- Days 10: Now, it's time to focus on validating the Quality Score.

- Days 15: With enough data, measure ROAS, Impression Share, Ad Position.

By structuring our paid ads with custom store listings, we expect faster results and a 50% boost in acquisitions, noting that ads currently drive 70% of acquisitions for Zobaze.

-- Not prioritizing as of now basis the Acquisition channel prioritization framework --

This acquisition channel opens two doors for Zobaze: Referral program & Partner (Reseller) program. Each has its own pros and cons as below;

Factor | Reseller Program | Referral Program |

|---|---|---|

Time to Set Up | Medium to High (Training, onboarding) | Low (Quick to set up) |

Time to Run | High | Low |

ROI Potential | High (Direct sales by resellers) | Moderate (Indirect, depends on referrals) |

Effort Required | High (Ongoing support, relationship mgmt.) | Low (Mainly tracking and occasional rewards) |

Operational Complexity | High (Commission, tracking, billing) | Low to Moderate (Simple referral tracking) |

Tech Needs | CRM, reseller portal, commission tracking | Basic referral tracking, unique codes |

Though a Reseller program offers a high ROI, at Zobaze's current stage (Early Scaling), a Referral program seems more conducive. A Referral program provides flexibility, takes less time to set up and operate, and requires less effort overall. With a robust tracking system in place, the Referral program should yield solid results, especially given our ICP, who tends to prefer trying referred products rather than exploring independently.

Taking all these factors into account, a Referral program appears more fruitful for Zobaze at this moment. As the product matures and all features are fully developed, we can then target a larger market through Reseller programs, which, for now, are too rigid and challenging to manage effectively.

Referral Program

Before designing a Referral program, there are three essential questions to answer: Whom to ask, When to ask, and Where to ask for referrals.

Whom to Ask for Referrals?

While it might seem obvious to ask existing customers to refer, it's not quite that simple. At this Early Scaling stage, it’s crucial to target only the right ICP consistently.

Not every user will randomly promote your product—so who should you target? The answer lies with those who have experienced the core value proposition of your product: users who have hit the AHA moment, and those who are likely to “brag” about it. These are the users primed to refer others and the ones you should target for your Referral program.

When to Ask?

Timing is everything. Imagine you missed your train and quickly opened Paytm to book the next available option, booked a train, and finished your journey with relief.

If Paytm prompted you to refer a friend while you were booking, you’d likely ignore—or even resent—it. However, if they ask for a referral when you’re pleased with the journey and have just left a 5-star review, your likelihood of sharing increases. The simple takeaway? Ask users to refer when they experience their AHA moment—in their “happy flow.”

Where to Ask?

Inside the app! But it’s not just about location; think of it like real estate. Just as prime locations carry a premium, so do prime positions within your app. Avoid using valuable home page space for referrals.

Instead, follow this key rule: never interrupt transacting users, such as completing a subscription payment or engaging in a core activity.

Happy flows & Brag worthy moments

When 84% of Zobaze users say Zobaze helps them in tracking sales/profits/cash flows. Let's explore this with a User story.

As a store owner, what truly matters is the money made at the end of the day before closing up. Imagine Zobaze sending a reassuring message like this right before they lock up:

Hey {business_owner},

Kudos to your hard work. Your business has made xxxx profits today.

But the real game begins when the user opens their store the next day and launches the app for the first time.

Hey {business_owner},

Good day starts by sharing goodness. Invite your friends & help them.

Every user experiences their own unique AHA moments and “happy flows.”

- Exploring reports and uncovering daily, weekly, or monthly cash flows is crucial for businesses as it aids in planning expenses or forecasting earnings.

- Some users may find stock management to be a major challenge, making a referral prompt effective right after an alert about low stock or expiring inventory.

- Others may struggle with following up on customer debts. Imagine a reminder that helps them successfully collect overdue payments—this would be an ideal moment to encourage a referral.

The possibilities are endless. With these varied touchpoints, we can continually refine our positioning to discover what resonates best with each segment.

Similarly, for someone with limited tech exposure, managing their entire business—their lifeline—right from their mobile is worth bragging about. Our users proudly say, “I run my business from anywhere!”

What's the win-win?

Even when users experience that AHA moment, they may not be inclined to refer on their own. What’s the motivator? Platform Currency—a form of reimbursement they earn for successful referrals.

What you offer must make your customers use your own product more.

Is it just money that we can offer?? Consider what other tools users might rely on in their business alongside your product—like printers, paper rolls, printer ink, Microsoft Excel, desktops, and so on.

To decide what to offer, we need to know the Return on Investment (ROI) and Customer Acquisition Cost (CAC):

| Metric | Details | Calculation | Value (INR) |

|---|---|---|---|

Monthly Subscription | Cost per month | - | 299 |

Annual Subscription | Cost per year | - | 2999 |

Referral Program | Platform currency reward for referrer per successful referral | -100 (if INR 100 is the offer) | -100 |

New User Discount (Monthly Plan) | 10% discount on the first monthly purchase for the referred user | 299 - (10%, if referee gets 10% off) | 269 |

Discount Cost per Referral | 10% discount for new user | -30 | -30 |

Net Revenue per Referral | Revenue after discount and platform currency | 299 - 100 - 30 | 169 |

Total Cost per Referral | Total cost (platform currency + discount cost) | 100 + 30 | 130 |

Customer Acquisition Cost (CAC) | Cost per new user acquired | 130 | 130 |

Return on Investment (ROI) | (Net Revenue per Referral - Total Cost per Referral) / Total Cost per Referral | (169 - 130) / 130 | 30% |

Earnings per Referral | Net earnings per successful referral | - | 169 |

Expecting 100 Referrers per month | Estimated total new users from referrals | 100 referrers * 3 | 300 new users |

Projected Monthly Revenue | Monthly revenue from new referrals | 300 users * 169 | 50,700 |

Projected Monthly Program Cost | Total monthly cost of referral program | 300 users * 130 | 39,000 |

Net Monthly Earnings | Monthly earnings after program costs | 50,700 - 39,000 | 11,700 |

To keep the program effective, we should also track key metrics like the Conversion Rate of Referrals, Referral Activity Rate, and the Retention Rate of Referred Users.

With positive earnings, we can enhance our strategy by adding milestone rewards for active referrers.

For example, we could offer products like printers, printer ink, paper rolls, or even a desktop based on the number of successful referrals they bring in.

Referral Program landing page

Designing the Referral Program landing page is just as important as planning the strategy itself.

Key questions to address:

- Is the page clearly communicating what users will gain?

- Is it guiding them on how to refer?

- Which channel is easiest for sharing?

Here, WhatsApp is primary, given its popularity among business owners who use it for group communication. As a secondary channel, Facebook works well since many users are active in social retail communities there. - How should the creative and copy be?

Personalized—tailoring the message to feel relevant and approachable for each user.

After all this, how should users track?

After making a referral, users want to track the status of their referral, which is key. Providing this visibility not only satisfies their curiosity but also encourages them to follow-up. This approach boosts engagement, as users feel invested in the process, enhancing the overall success of the referral program.

Note: Avoid being too pushy when encouraging referrers to remind their referrals.

With the right metrics in place and the referral program live, we can achieve at least a 20% growth in new acquisitions.

For reference, CRED gains 35% of its users through referrals, showing how powerful a well-structured referral program can be for acquisition with minimal effort.

As Zobaze approaches the Mature stage, it’s the ideal time to explore a Reseller (partner) program. Here are a few references from competitors successfully leveraging reseller programs:

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.